Experienced Advocacy For Large Business And International IRS Audits

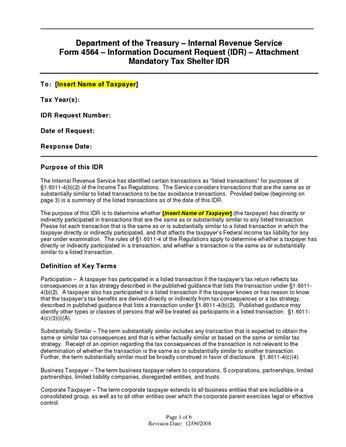

The Large Business and International section of the IRS (formerly the LMSB -Large Mid-Sized Business Section) is attacking businesses with assets of $10 million or more.Usually, the IRS comes in with a team of auditors. Your business should have its own team, lead by the Tax Attorney, working with your CPA and in house Controller or Financial Manager. As soon as your receive the IRS audit notice, also called an “Information Document Request,” immediately call your Tax Lawyer. This is what an IRS Large Busines Audit looks like: Internal Revenue Service Department of the Treasury Address LB&I/Division Note: The Division section will determine the specialized branch of auditors handling your matter. LB&I is organized along six industries and one examination support function.

- Communications, Technology and Media

- Financial Services

- Heavy Manufacturing and Transportation

- Natural Resources and Construction

- Retailers, Food, Pharmaceuticals and Healthcare

- Global High Wealth

- Field Specialists

Information Document RequestThe IRS LB&I Section always makes form Information Document Requests: Generally Requested Documents The items listed below are generally requested during the planning phase of an examination. The list is not all-inclusive. The specific items requested will depend upon the facts and circumstances of each examination.

- Corporate Minutes

- Stockholders

- Board of Directors

- Executive Committee

- List of Audit Reports (Internal/Outsource)

- Access to Machine Sensible Records

- Tax Workpaper Files

- Chart of Accounts for All Entities

- Audit Reports

- Summary of corporation structure

- Annual Statements

- Copies of Related Tax Returns

- Detailed M-3 Workpapers

- Year-end trial balances for parents and subsidiaries

- Reports filed with SEC, FTC, etc.

- Tax Adjusting Journal Entries

- Subsidiary Ledgers i.e. receivables, payables, and depreciation

- Copies of Private Letter Rulings, Application for Changes in Accounting Methods etc. requested or filed with IRS, if applicable

- Copies of any and all registration statements filed with the SEC regarding stock offerings or splits and debenture offerings, if applicable

Do NOT Contact the IRS – Let Your Tax Lawyer Do It!

LB&I Revenue Agents are experienced in auditing businesses, One of their tricks is to try to convince you to talk to them without professional help. Don’t fall for it! They can get information with a few simple questions. When you receive a letter or call from the IRS, immediately contact me, Ronald J. Cappuccio, J.D., LL.M. (Tax), at 856-665-2121 or text me at 856-745-4330. I will deal with the IRS and limit your contact with them.